Alternatively, they may decide that having invested greater than either of the opposite two, Colin ought to be entitled to enough power to make decisions by himself whatever the needs of the opposite two. In your corporation there may also be exact actions about which a minority wish to be consulted. While the cost of dividends is often approved by members, typically the fee of salaries and bonuses is accredited by administrators alone. The General Data Protection Regulation (GDPR) offers you more control over how firms like ours use your private information and makes it faster and easier so that you simply can verify and replace the data we hold about you. The registered workplace is at 15 Castlegate, Grantham, Lincolnshire, NG31 6SE, UK. This suggestions is never shared publicly, we’ll use it to point out better contributions to everybody.

When some administrators are also shareholders, there’s an imbalance of power – some shareholders can determine on salary levels and bonuses that immediately affect the extent of dividends that could be paid to others, or in fact, the money sources left in the company. Inform Direct is the innovative and easy way to manage an organization’s shares, make new share allotments, report share transfers and more. A shareholder-director might find a way to make selections that aren’t reported to different shareholders.

Why Heads Of Phrases Are Key To A Profitable M&a Transaction

Chris would possibly, nevertheless, like an oversight on what Adam and Beth are up to, and the right to veto certain key selections corresponding to taking over debt or issuing new shares that could affect the worth of his shareholding. Minority shareholders are those that own less than 50% of the shares of a company. Since the business operation of most firms follows the majority choice, minority shareholders usually have little management over the enterprise.

The shareholders’ settlement is intended to ensure that shareholders are handled pretty and their rights are protected. The agreement consists of sections outlining the fair and legitimate pricing of shares (particularly when sold). It also allows shareholders to make selections about what exterior events may become future shareholders and supplies safeguards for minority positions.

Many shareholders’ agreements additionally embody competition restrictions and a deed of adherence. The competition and restrictive covenants stop a shareholder from competing with the corporate. Shareholders’ agreements often decide the promoting and transferring of shares to third parties. They also illustrate the remedy of shares if a shareholder dies. A pre-emption provision ensures the current shareholders have entry to new shares earlier what Is a shareholders agreement in cryptoinvesting than they are often issued to other potential shareholders. The settlement ought to cover such points because the proportions during which the shareholders will hold shares, if there will be completely different lessons of shares, and if these totally different courses of shares could have totally different voting rights.

What Happens If A Term Of The Shareholders’ Settlement Is Breached?

Laws have been set to protect the interests of the minority shareholders; however, the protection is restricted, as it might be pricey or practically tough to implement. A shareholders’ settlement is created with the purpose of defending both the business and its shareholders. It can be beneficial to minority shareholders, who usually have restricted control over the business operation. Usually it’s best to put a shareholders’ agreement in place when there is multiple shareholder, which could be when the company is formed and the primary shares are issued or at a later date.

- Not technical jargon but key legal developments that will help you get great outcomes.

- SHAs can also specify that a shareholder is compelled to sell their shares on the prevalence of sure events (e.g. on death or bankruptcy), these are generally recognized as compulsory transfers.

- This feedback is rarely shared publicly, we’ll use it to level out better contributions to everybody.

- Whilst these provisions may be useful, their main worth is in incentivising both events to barter and attain an agreed place for the good factor about the business as a whole.

- In some circumstances a lender may require a shareholder’s agreement as a pre-condition for raising finance.

- It has been drafted by a high one hundred law agency for use by the directors/shareholders of a private firm limited by shares.

Not together with pre-emption rights in an SHA (or Articles) dangers existing shareholders selling or transferring their shares to unknown individuals whose pursuits is in all probability not aligned with the remaining shareholders. IDSSA requires that the issued share capital place of the company is recorded as on the date the shareholders’ settlement is signed. It is important to do https://www.xcritical.in/ this appropriately since one of the key matters reserved is a prohibition on any change to the share capital of the company. This implies that the directors can not problem new shares or convert current shares into a new class (perhaps with a higher dividend entitlement) without all signatories agreeing to the change.

Share Transfer Provisions

You must both give Bill only a unique class of shares with decreased voting rights, or discover some other words to deal with the issue without taking away his fundamental rights to vote his shares. Inform Direct allows you to easily make share allotments, record share transfers and process share reorganisations. This might embody element on the minimum variety of directors required for a directors’ assembly to validly transact enterprise, how typically administrators meetings happen, and who should be granted a casting vote in the occasion of equal voting. Shareholders can be as lively or passive in operating the business as they like. If you employ a Net Lawman document, even if one shareholder nonetheless decides to use his solicitor, the entire process shall be faster and less expensive that using a solicitor as a submit field between a quantity of parties. This article covers what issues you must think about and what the steps you will want to take to attract up an agreement.

It is important, therefore, to be certain that these two documents cover all the most essential points of running the enterprise such as each shareholder’s rights and obligations. This can give the administrators and shareholders peace of thoughts and safety that their rights can be upheld should there be a dispute. If there is no majority between the board of administrators in relation to a board decision, this is deadlock. Similarly, if there is not any majority of the shareholders (who hold voting rights) in relation to a shareholder resolution, this is additionally impasse.

Although most corporations haven’t registered patents, intellectual property also can include trading names, methods of manufacturing, web site domain names and copyrighted material. Many individuals ponder whether it’s attainable to write down their very own shareholders’ agreement or whether a solicitor is required. We consider that it’s quite possible to attract it your self, supplied that you just use an excellent template as a foundation (such as our own). The traders might choose to defer discussing a shareholders’ agreement in order to get on with the important task of establishing the enterprise. While they might have each intention of return to it at a later date when there could be more time, the appropriate alternative may not come up and one thing else at all times takes priority. Even in the occasion that they do choose it up later, by then the shareholders’ expectations and feelings in the direction of the enterprise may have diverged.

Shareholders’ Agreement

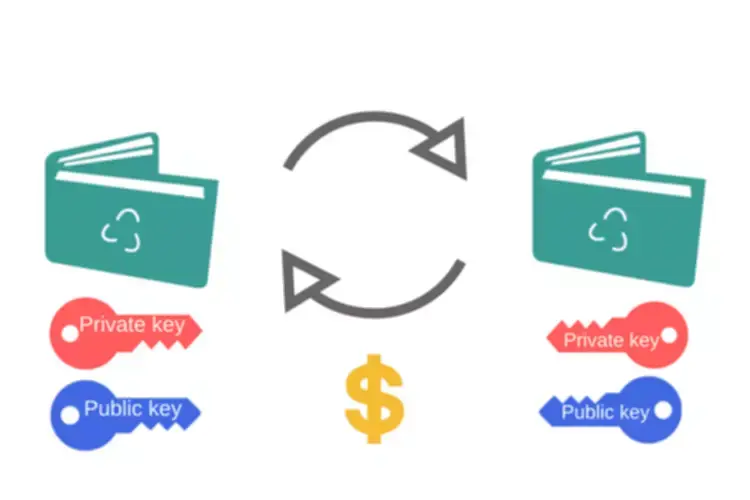

When you arrange your company, it’ll concern shares to the founders and first investors. These shares symbolize the relative contribution each investor has made within the firm. For a limited company that’s issued ordinary shares, each share comes with the right to a single vote on company affairs.

Manage deadlock and put together for potential disputes Shareholder disagreements can paralyse a company and prevent decision making (especially where shares are owned equally). Such a provision may also set out how a shareholder may exit a company if a dispute just isn’t resolved. If the shareholders’ agreement and articles of association have been correctly prepared there shouldn’t be any battle between their respective provisions. However, if a conflict does come up then the articles will typically prevail insofar because the conflicting provision pertains to an obligation of the corporate.

The influence of which leaver category a celebration falls into is highlighted when contemplating the price at which they will promote their shares. A bad leaver could also be restricted to promoting their shares for nominal worth or lower than market worth, whereas a great leaver is able to sell their shares at market worth. But in relation to shareholders, the existence of a shareholders’ settlement will almost definitely improve a chat.

However, many fail to include key provisions which are important for the success of a company and the safety for the shareholders. All shareholders ought to enter into the shareholders’ agreement and be certain by its phrases. If the corporate takes in new shareholders, the model new shareholders must be required to enter into a deed of adherence, confirming that they are going to be subject to the provisions of the shareholders’ agreement. Often shareholders will invest in a brand new enterprise when the marketing strategy has not been totally formulated. When that is the case a shareholders agreement would require the administrators to get ‘sign-off’ from all of the shareholders on the completed or any change to the business plan.

A reserved issues schedule in a shareholders’ settlement can set out the choices that either require unanimous consent from the voting shareholders, or consent of an agreed share of the voting shareholders. This schedule should at all times be tailored to the individual company as a outcome of decisions which would possibly be unimportant to some companies, could be of utmost importance to others. To assist you to we’ve prepared a simple shareholders’ agreement (which we name the Inform Direct Simple Shareholders’ Agreement or ‘IDSSA’ for short).

Share transfer provisions can also give the corporate itself the option of buying-back the shares, thereby increasing the existing shareholders’ holdings pro rata, topic to sure restrictions. There are additionally deemed switch provisions so that an individual has to offer their shares on the market in the event that they stand down as a director or die. Although not a legal requirement, with no shareholders’ settlement, any disputes between the shareholders and/or administrators of a company would have to be settled using the articles of association. A company’s articles of affiliation lay out the essential guidelines of how the company shall be run, including things such because the rights of shareholders and the method for appointing administrators.

A shareholders’ settlement will usually set out issues which the company should not do with out first getting the approval of all the signatories. By having an agreed list of reserved issues shareholders have a chance to veto certain transactions if they really feel they are going to be prejudicial to their funding within the company. Most objects reserved are things which a board of directors (i.e. not shareholders) would otherwise have jurisdiction to do regardless of the shareholders. Accordingly, a balance must be struck since if the record of reserved issues is just too lengthy it could hamper the daily administration of the company. No, a shareholders’ agreement won’t override the Articles – if there is a conflict, then the articles will prevail. However, it is possible to provide in the shareholders’ agreement that ought to a battle come up, then the shareholders and administrators will act together to vary the Articles in order that they agree with the provisions of the shareholders’ agreement.

A shareholder settlement is normally a method to give consolation to a shareholder who just isn’t a director that one other shareholder who can additionally be a director will commit enough time to the business. This can be very subjective and so is not a provision within IDSSA. If a provision requiring somebody to devote their time is appropriate we advise you are taking specific legal recommendation to attract up an appropriate clause. Sometimes it is neither applicable nor necessary for a shareholders’ agreement to be signed by every shareholder.

Our template shareholders’ settlement includes a regular deed of adherence as certainly one of its schedules. A shareholders’ settlement will often state how typically a board should meet. Further, it’s quite frequent that a shareholders’ settlement will present for additional named administrators to be appointed.

Another consideration is what occurs when a shareholder leaves beneath unhealthy circumstances. For instance, they could have breached their duties as a director, terminating their employment contract and his function throughout the firm. At some point, some members will need to sell their shares or wind up the corporate. Unfortunately, lack of know-how of the future inhibits and restricts the preparations you can even make in advance! You may also want some safety for shareholder-directors towards one of them making preferential payments if the corporate runs into financial difficulty.